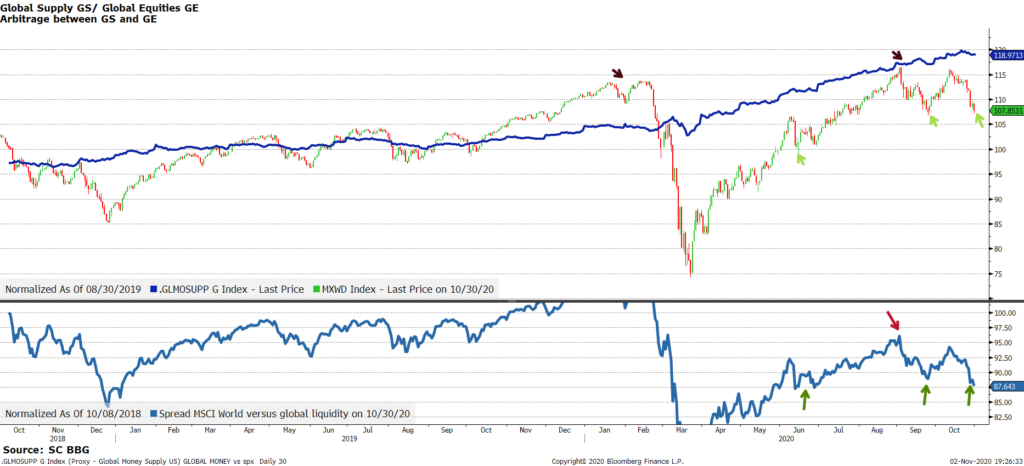

Chart 1 shows the MSCI World undegoing a second 8% sell-off in October after September. The second wave of the Covid19 is, a posteriori, the trigger for this correction, while the uncertainty around the US election creates a lot of volatility. Technically, we find a strong risk-reward to go long ahead of the US election outcome. RSI for global equities is oversold but forming a bullish divergence – The percentage of members above their 50 days moving average is also extremely oversold (have to go back to March to get such low readings) – last but not least, the MXWD is consolidationg towards its wave IV elliott wave with a possible downside target not far at 530, which corresponds to the 200 days moving average. All these technical items favour a high risk reward bullish setup for the end of the year, with a 636 target, or a 15% return.

CHART 1: MSCI World

Source: Bloomberg – Stouff Capital

Our trading plan (See Chart 4) is based on the 3 scenarii: (1) a step higher to 3,690 if the US election is not delayed and brings a pro market outcome (Biden or Trump with a split congress), with central banks still very accommodative (target is increased to 4,000 if a vaccine comes before the end of the year), (2) a Blue wave scenario with a first range trading between 3,100 and 3,350 depending on the characteristics of this win (should be not too progressive for the market), followed by a multi-months rebound first to 3,692 then to 3,915 in May 2021 (3) a return to extreme volatility owing to a delay of the election in a second wave Covid-19 environment (target range 2880-3150). Thus, only a delay or a contested election would be negative for markets and the risk-reward seems stronger at the current lower levels. We have closed a lot of our shorts in US and Europe while adding new long trades: in US, we have closed partially our short on the Nasdaq future, gone long Biotech stocks, which have probably too much corrected in the weeks, delta-hedge our long VIX exposure. We also have set-up specific trades that have a strong risk-reward if the Blue wave scenario is not happening: long US banks like JPM (after its very good earnings result), short the over-loved and over-owned Blue wave Solar ETF. In Europe, we have closed some shorts on the DAX, SDR LN and went long Eurostoxx50 Dividends 2022 and Swiss stocks at a very attractive level. This constructive view is directly supported by the massive liquidity injected gloobally by Central banks, as shown in Chart 2 which compares global equities performance with a proxy for global liquidity.

CHART 2: Global liquidity proxy gives a strong BUY signal for global equities

Source: Bloomberg – Stouff Capital

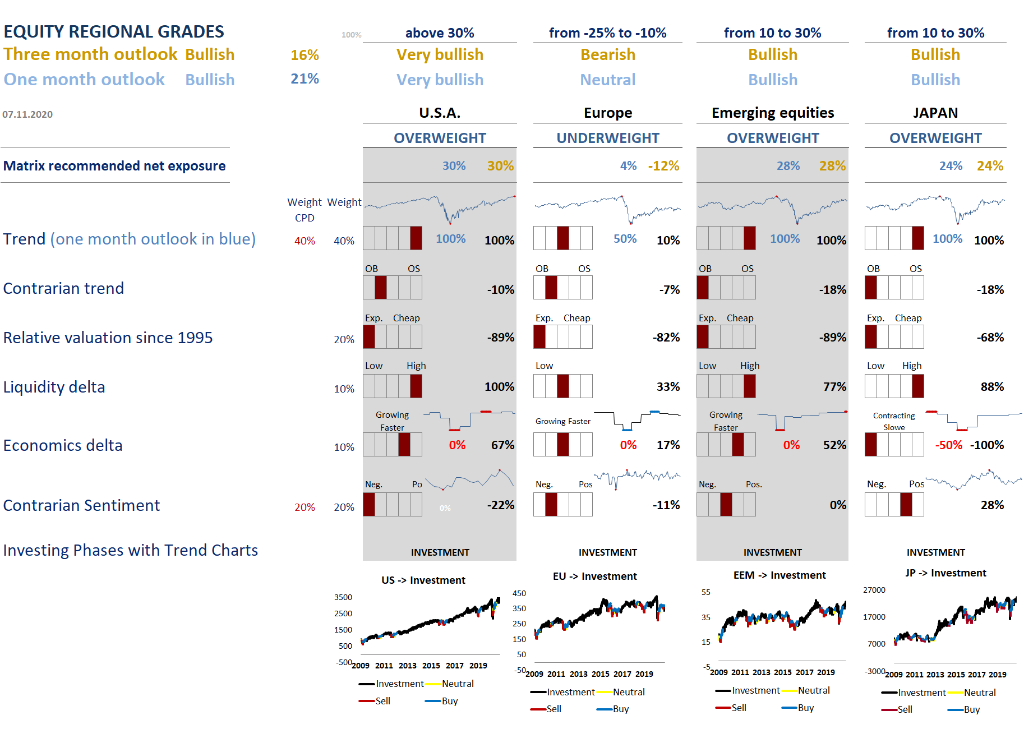

What our Matrix tells us ? Buy the dip for the end of 2020

EQUITY REGIONAL GRADES, GLOBAL EQUITIES MATRIX 07.11.20

Source: Bloomberg – Stouff Capital

Our Matrix had switched in CPD (Change point detection = bearish) in August and recommended hedging our US and European exposures. This CPD state was cancelled when sentiment became too cautious again by the end of September and now October, as indexes form a double bottom in their various wave 4 targets. The Matrix has evolved to a bullish state for the medium run, with an Overweight rating for US, EM and Japan. Europe stays Underweight but its investing phase has been upgraded from Trading to Investment

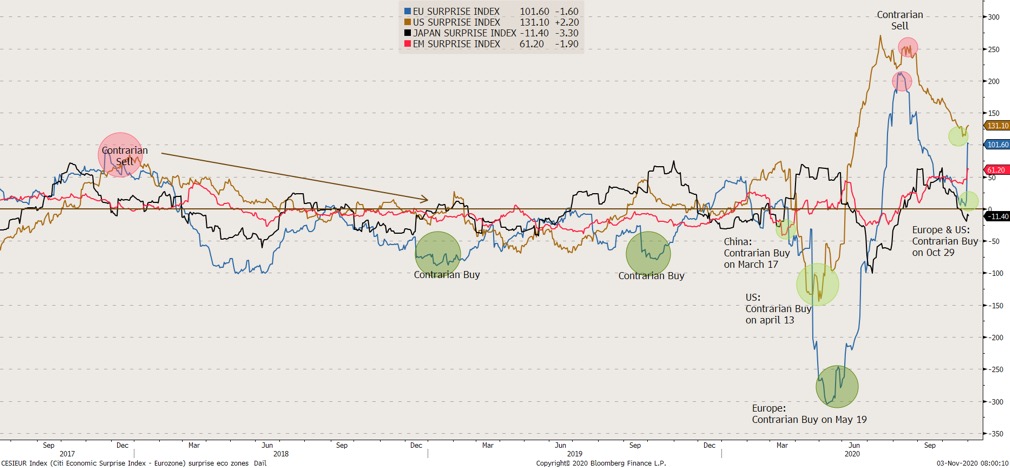

Economics & Sentiment grades are turning better

Our Economics grade had exited its CPD (Change point detection) as the Citigroup surprise indexes had turned back north. Indeed, global manufacturing PMIs reached a new cycle high of 54.2, up from 52.9 in September. 78% of the economies have an expanding new orders index and the global manufacturing PMI is already close to previous highs with global GDP looking to have rebounded 37.1%. Surprisingly, capex has risen 5% above its pre-crisis levels. A final demand pickup has also turned the inventory cycle, pointing to a strong additional growth boost from stock-building this quarter and next. This is is a strong positive, that must be monitored for a continued rotation towards value and high beta. Furthermore, our SC US & Japanese Sentiment grades have just flashed short-term bullish signal, which was triggered when the S&P500 reverses 1.5% from its intraday low on October 30th. We think the second wave of COVID-19 should not repeat the March crash for 2 reasons: (1) global central banks stand ready to limit the spillovers from lockdowns to financial conditions. To this end they are continuing to increase their balances sheets and maintain emergency credit easing programs. The Fed is purchasing $120bn/month of UST and MBS, and the ECB’s existing PEPP program has sufficient firepower to keep purchasing at its current pace through mid-2021. G3 central banks to purchase an astounding $4.3tn in assets over the coming year; and (2) the coming vaccine.

CHART 3 : SURPRISE ECONOMIC INDICATORS – 03.11.20

Source: Bloomberg – Stouff Capital

As a conclusion, we expect that global equities should benefit from the least traumatic political outcome, central banks liquidity, supporting stronger PMIs in 2021, and hopefully better virus newsflow. Markets should continue grinding higher, possibly 15% until the end of the year with the S&P500 between 3700 and 3900. Our matrix is Overweight US (Health-Care, Tech) and Emerging equities.

CHART 4: S&P500 US Elections simulation Tree – 02.11.20

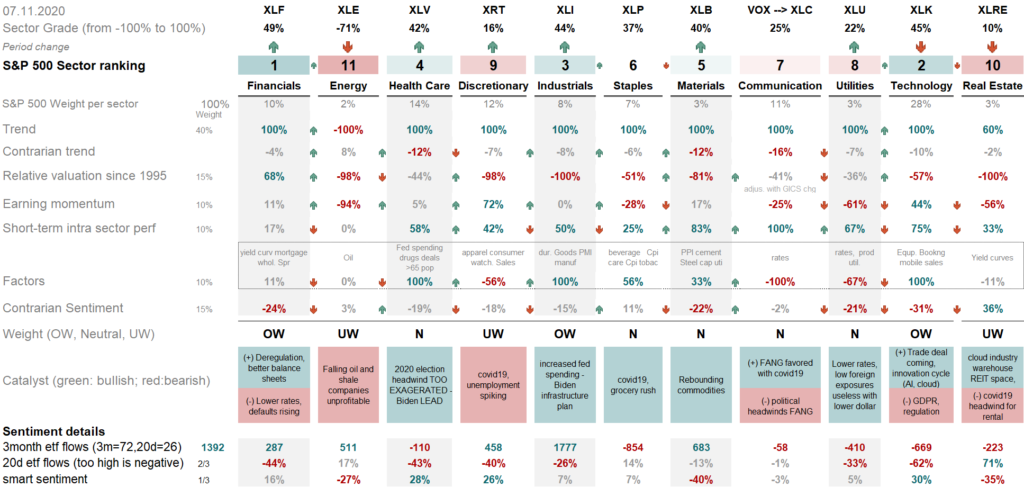

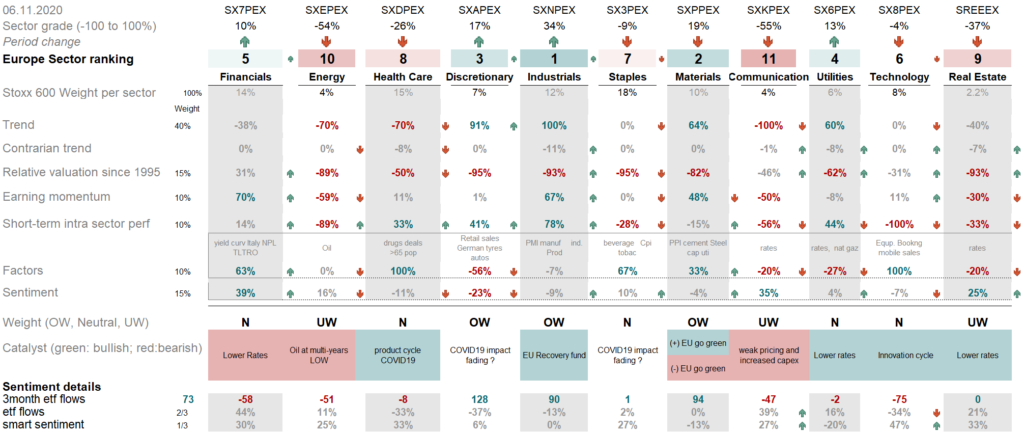

In terms of Sector allocation, for the first time in 2 years, Financials are OW as well in Europe than in US, as shown in charts 5 & 6. Financials have even reached the pole position in the US, supported by a good earnings momentum and the only positive relative valuation compared to all other sectors. In Europe, the 3 OW sectors are cyclicals, in line with the rebound of our matrix Economics grade.

CHART 5: US Sector ranking – 07.11.20

CHART 6: European Sector ranking – 07.11.20

Disclaimer:

This marketing document is issued by Stouff Capital. It is neither directed to, nor intended for distribution or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. The information and data presented in this document are not to be considered as an offer or solicitation to buy, sell or subscribe to any securities or financial instruments. Information, opinions and estimates contained in this document reflect a judgment at the original date of publication and are subject to change without notice. Any reference to benchmarks/indices herein are provided for information purposes only. No benchmark/index is directly comparable to the investment objectives, strategy or universe of Stouff Capital. For further information on the index please refer to the website of its service provider. Stouff Capital has not taken any steps to ensure that the securities referred to in this document are suitable for any particular investor and this document is not to be relied upon in substitution for the exercise of independent judgment. Tax treatment depends on the individual circumstances of each investor and may be subject to change in the future. Before making any investment decision, investors are recommended to ascertain if this investment is suitable for them in light of their financial knowledge and experience, investment goals and financial situation, and/or to obtain specific advice from an industry professional. The value and income of any of the securities or financial instruments mentioned in this document may fall as well as rise and, as a consequence, investors may receive back less than originally invested. The investment risks described herein are not purported to be exhaustive. Past performance is neither guarantee nor a reliable indicator of future results. Performance data does not include the commissions and fees charged at the time of subscribing for or redeeming shares. Investors investing in investments and/or treasury products denominated in foreign currency should be aware of the risk of exchange rate fluctuations that may cause loss of principal when foreign currency is converted to the investors home currency. This document is confidential and intended solely for the use of the recipient. It must not be reproduced, distributed or published in whole or in part by any recipient for any purpose without the prior consent of Stouff Capital.