The wall street journal

July 2023 Article: Our Economics grade is still constructive in the USA

“We don’t see the recession” in the data, said Julien Stouff, founder of hedge-fund firm Stouff Capital in Geneva.

Stouff Capital has been shortlisted in the Hedgeweek European Awards 2023

December 2022

Link to the dedicated Awards page

The wall street journal

November 2022 Article (Investors Question Whether Big Tech’s Rebound Can Last)

This is typical of a big bear market rally”, said Julien Stouff, founder of hedge-fund firm Stouff Capital. “It is not over.”

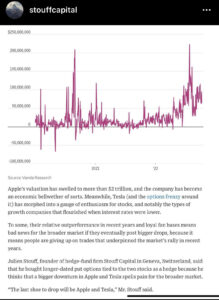

October 2022 Article (click on right hand picture to read more on our purchases of long term put on Tesla and Apple)

The last shoe to drop will be Apple and Tesla.”

September 2022 Article on how we risk-manage fast bear market rallies with daily options

This market is very dangerous, Everyday is a new day, it’s a new market.”

HFM European Performance Awards 2022: Urizen is Shortlisted for best global and European Equity

The wall street journal

May 2022

Julien Stouff, founder of hedge-fund firm Stouff Capital in Geneva, Switzerland, said that he has put on a position that would profit if the rally continued in the near-term, though he doesn’t think the selloff is over yet. He said that market volatility has been edging lower lately and many investors appear to already have dumped their stock-market bets. “Right now we are bullish” in the short-term, Mr. Stouff said.

L’inflation ou le pari de Pascal

Allnews, February 2022

«Pesons le gain et la perte. Estimons ces deux cas: si vous gagnez, vous gagnez tout; si vous perdez, vous ne perdez rien. Gagez donc que l’inflation est, sans hésiter.»

Link to the article – en francais

The wall street journal

February 2022

Julien Stouff, founder of hedge-fund firm Stouff Capital in Geneva, Switzerland, said he placed short-term bullish bets on stocks in January around the time he noticed many traders growing more pessimistic on the market. Recently, he has taken a neutral stance through the options market.

Link to the article in English – WSJ or the video from Gunjan Banerji, in Italian, in Chinese

December 2021 at Hotel des Bergues

Watch our video on our views for 2022

Opalesque

Geneva-based manager Stouff Capital to launch global macro hedge fund, Opalesque

December 2021

Link to the article – Opalesque

swissnews.info, l’agefi, allnews, Opalesque, CityWire

Stouff Capital dépasse son objectif de rendement et double son encours sous gestion en 12 mois

Stouff Capital verdoppelt verwaltetes Vermögen und beruft Senior Portfolio Manager

Stouff Capital doubles AuM in twelve months

December 2021

Link to the article – Swissnews.info

Link to the article and pdf in page 4 – Agefi

In Deutsch – Citywire and Presseportal

HFM European Quant Performance Awards 2021: Shortlist Announced

Urizen fund, our global Equity Absolute return fund is shortlisted for the HFM European Quant awards 2021

Stouff Capital expects to launch crypto/ macro fund in 2022

Bloomberg, October 2021

Stouff Capital intends to launch his own global macro hedge fund. in the first quarter of next year. The fund will bet on crypto assets and global equities.

L’art de la tragédie

Allnews, Aout 2021

Link to the article (French)

De 2013 à 2014, nous avons nommé l’anxiété du marché sur le tapering (arrêt progressif des achats d’actifs financiers dans le cadre du programme d’assouplissement quantitatif QE) de la Réserve fédérale, «l’art de la tragédie». En tant que concept de déjà-vu, l’art de la tragédie hante à nouveau les investisseurs avec la forte hausse de l’inflation. Cela a mis la pression à maintes reprises en 2021 sur les actifs risqués dont les valorisations (très) élevées doivent maintenant intégrer la fin des conditions monétaires extrêmes accommodantes.

Participate (click here) at the HEC Lausanne JE business game, made by Stouff Capital (instagram) on March 25th, 2021

New Swiss hedge fund Stouff Capital triples assets under management

Opalesque, December 2020

Link to the report on pages 7 & 8

… driven by the alpha generated from the selection of long and short securities. Starting with the weekly quantitative selection of the best and worst companies produced by its algorithms from an investment universe comprising the world’s largest capitalisations, the fundamental analyst retained 100 long and 50 short positions on the basis of its own convictions, current themes and specific events. The long portfolios that used this approach outperformed their respective benchmarks by 5% year-on-year and the short portfolios underperformed by 9%, with the portfolios as a whole producing an annual gross contribution of 9.5%.

Watch our video made on November 20th, 2020

Stouff Capital triple ses actifs sous gestion

Allnews, November 2020

Link to the article (French) , German or Italian

Après une période boursière mouvementée, Stouff Capital a réussi à atteindre son objectif de performance au cours de ses deux premières années d’existence. Le gérant d’actifs genevois a généré une performance nette de 13,5%, avec une volatilité de 1/3 de celle du marché. Surperformant les indices de Hedge Fund Equity et les fonds quantitatifs majoritairement en territoire négatif, son fonds a su tirer profit de 2 fortes baisses de marché sur 4, grâce à un profil de rendement asymétrique visant à limiter les pertes lors de baisses de marchés tout en bénéficiant des hausses.

L’asset Management Suisse en 56 noms

Sphère , Juin- août 2020

«Nous structurons le portefeuille pour qu’il résiste à l’improbable»

Sphère – Jérôme Sicard, 1H 2020

Quelles sont les cases qu’il faut cocher aujourd’hui pour lancer un hedge fund?

Julien Stouff: Il faut tout d’abord maîtriser la technologie au niveau des différents outils d’aide à la décision et d’implémentation. C’est de cette maîtrise dont va dépendre une gestion des risques extrêmement pointue qui mesure pleinement les impacts directs de nos décisions de gestion. J’insiste, mais il est vraiment impératif aujourd’hui de mettre la gestion du risque au cœur du processus de gestion. Il ne s’agit pas de supprimer le risque ou de l’atténuer mais de prendre le risque adéquat, de la même façon que les freins d’une voiture servent aussi à aller plus vite. Pour nous, c’est avec cette logique que nous parvenons à calibrer une performance de 7% net par an avec des drawdowns contrôlés de 3 à 6%.

New Geneva equity hedge fund prepares for coming bear markets

Zero management fees

Stouff also wants to be ahead of the curve within the asset management industry; he is convinced that we live in a new era. Whereas in the recent past, investors sought a good performance along with a fairly priced fee, now, what with algorithms and passive management, it’s over. Investors want a good performance together with the best fees. So he created a fund that is “cheaper than an ETF”, as it indeed does not charge any management fees.

“We will only get paid if we create returns for our investors, and for ourselves.”

Un an de gestion quantamentale

Certains fonds alternatifs se tiennent prêts pour les Black Swans. C’est le cas du fonds de type Absolute Return de Stouff Capital qui s’est distingué lors de la baisse des marchés d’octobre à décembre 2018. Encore inédite en Europe, la gestion quantamentale marie les approches quantitative et humaine

Stouff Capital outperforms the markets and bolsters client confidence Stouff Capital: un hedge fund actions globales

One year after launching its absolute return fund and the announcement that it had entered into a distribution agreement for qualified investors with REYL Group, Stouff Capital has outperformed both the global equity markets and the hedge fund indices. It has bolstered client confidence with its disruptive product offering based on a quantamental strategy.

Founded in 2018 in Geneva, Stouff Capital favours a quantamental investment style – innovative in Europe – combining quantitative analysis with a human-led fundamental approach. This systematic process helps eliminate emotional behavioural biases associated with purely fundamental investment and improve returns under different macroeconomic conditions and market regimes.

Lancement à Genève de Stouff Capital: un hedge fund actions globales

Juin 2018, Agefi

Le nombre de start-up hedge fund est au plus bas historique. Julien Stouff, fondateur de Stouff Capital, le reconnaît aisément. Il estime néanmoins que les opportunités n’ont jamais été aussi évidentes: la hausse des taux d’intérêt, le retrait des liquidités des banques centrales, les risques de guerres commerciales et les risques géopolitiques (Brexit, risque politique italien), marquent un frein brutal à la hausse tranquille des marchés (d’actions et obligataires) depuis le début des politiques monétaires non conventionnelles.

Stouff Capital signe un accord de distribution avec le Groupe Reyl

Mai 2019, Agefi

Le groupe Reyl s’associe au gérant de hedge fund Stouff Capital. Créé en 2018 à Genève, Stouff Capital privilégie une gestion active exclusive dite quantamental qui marie analyse quantitative et approche humaine ou fondamentale. Ce processus systématique permet d’éliminer les biais de comportement émotionnels de l’investissement purement fondamental et d’améliorer les rendements à travers les différentes conditions macroéconomiques et les régimes de marchés.

Investi en actions internationales, Stouff Capital vise un objectif de rendement de l’ordre de 5 à 7% par an, avec un profil de volatilité conservateur entre 3 et 5%. L’avantage de cette approche discrétionnaire est de suivre les tendances en sachant prendre les points d’inflexion, notamment dans des marchés volatiles. L’offre disruptive de Stouff Capital réside dans le fait qu’aucun frais de gestion n’est pris pour l’ensemble de ses produits.

Former Pictet global trading head outlines boutique venture

June 2018, Citywireselector

Stouff said he has always had an entrepreneurial approach and tried to launch his own strategy even before joining Pictet in 2004. He said his current investment approach is ‘quantamental’, as both the long and short trades will be informed by a quantitative process. The two new funds are also going to integrate some elements of the Kronos fund which Stouff managed during his time at Pictet.

‘Kronos was a trading fund and what we called long convexity, so we tended to make a lot of money when there was a lot of volatility and disruption on the market, like in 2008. But then we had a drawdown in 2012, which coincided with the beginning of the QE when the volatility was falling.’

Ces petits hedge funds qui recrutent des traders et quants à Genève…

October 2018, efinancialcareers

Enfin, régulièrement, de nouveaux acteurs font leur apparition sur la scène genevoise des hedge funds. Dernier venu : Stouff Capital, fondé en juin dernier par deux anciens private bankers. Le nouveau fonds (orienté actions globales) sera dirigé par Julien Stouff, ex-responsable mondial de la stratégie trading de Pictet.

A ses côtés, Gregory Chevalley, ex-quant developper chez Pictet, sera en charge de la gestion quantitative et du risk management. « L’une des raisons pour lesquelles nous avons décidé de partir est que nous voulions lancer un fonds sans frais de gestion (management fees). Nous facturerons uniquement si nous performons et c’est la direction vers laquelle d’autres hedge funds pourraient se diriger dans le futur », expliquent les fondateurs. De quoi donner des idées à d’autres…

Hedge Funds: A Few Brave Funds Open as Startups Near Lows

June 2018, Bloomberg

Julien Stouff, formerly at Pictet & Cie, is starting Stouff Capital with Gregory Chevalley. The two will try to make money from rising and falling stocks.

Former Pictet Trader Stouff Says He’s Starting a Hedge Fund Firm

Feb 2018, Bloomberg

By Nishant Kumar(Bloomberg) —Julien Stouff, former global trading head of Pictet Trading & Strategy, is starting a hedge fund betting on rising and falling stocks.Stouff is setting up his investment firm — Stouff Capital — in Geneva withGregory Chevalley, the former head of quant at the same unit of Banque Pictet & Cie., the founder said on Wednesday. The fund will start in the second half of the year and use quantitative techniques, high-frequency trading and tail-risk hedging to bet on equities globally. Stouff declined to disclose details of the fund’s assets under management.The market is currently focusing on macro data, such as fiscal reforms, trade wars, debt and rising interest rates, Stouff said. That’s setting the stage for higher volatility and could lead to better trading opportunities, he said.Chevalley did not return calls and a LinkedIn message seeking comment.Stouff joins a number of other managers, such as former GLG Partners’ executive Himanshu Gulati and ex-BlueCrest Capital management’s Adam Aron, in starting their own shops. The new funds are being started as investors continue to warm to hedge funds.Investor inflows totaled $14 billion in the first quarter this year, with equity funds receiving the bulk of the allocations, according to eVestment’s latest data. That’s about half of the money allocated last year and is an about-turn from 2016 when investors pulled $112 billion, eVestment data said.Stouff left Pictet in April after 14 years, he said. Chevalley was at the Swiss firm for about eight years, according to a Stouff Capital investor presentation seen by Bloomberg News. A spokeswoman for Pictet declined to comment.