Low-vol portfolios

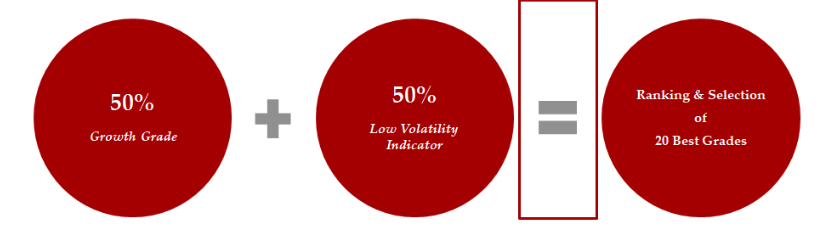

Low-Vol are purely quantitative portfolios, where stocks are selected by grades, constructed 50% from earnings-momentum grade and 50% low volatility grade.

Performance of USA Low-Vol Portfolio vs benchmark since 2012 (150% relative return):

USA Low-Vol Portfolio performance since 1 Oct 2018: (+19.83% relative return)

USA Low-Vol Portfolio performance in 2022: (+10.9% relative return)

Quantamental portfolios

Those portfolios are constructed with a combination of quantitative scores and qualitative insights.

USA quantamental Long portfolio performance since 1 Oct 2018 (+26.70 relative return):

USA quantamental Long portfolio performance in 2022 (+0.36 relative return):

USA quantamental Short portfolio performance since since 1 Oct 2018 (+46.22% relative performance – designed to underperform the benchmark):

USA quantamental Short portfolio performance in 2022 (-0.5% relative performance – designed to underperform the benchmark):

USA quantamental ESG portfolio performance since 1 Oct 2018 (+13% relative return):

Europe quantamental Long performance since 1 Oct 2018 (+23.20% relative performance) :

Europe quantamental Long performance in 2022 (+0.18% relative performance) :

Europe quantamental Short performance since 1 Oct 2018 (+28.80% relative performance – designed to underperform the benchmark):

Europe quantamental Short performance in 2022 (-1.30% relative performance – designed to underperform the benchmark):

Asia quantamental Long performance since 1 Oct 2018 (+37.80% relative performance – designed to underperform the benchmark):

Asia quantamental Long performance 2022 (-1.30% relative performance – designed to underperform the benchmark):

Disclaimer:

This marketing document is issued by Stouff Capital. It is neither directed to, nor intended for distribution or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation.

The information and data presented in this document are not to be considered as an offer or solicitation to buy, sell or subscribe to any securities or financial instruments. Information, opinions and estimates contained in this document reflect a judgment at the original date of publication and are subject to change without notice. Any reference to benchmarks/indices herein are provided for information purposes only. No benchmark/index is directly comparable to the investment objectives, strategy or universe of Stouff Capital. For further information on the index please refer to the website of its service provider.

Stouff Capital has not taken any steps to ensure that the securities referred to in this document are suitable for any particular investor and this document is not to be relied upon in substitution for the exercise of independent judgment. Tax treatment depends on the individual circumstances of each investor and may be subject to change in the future. Before making any investment decision, investors are recommended to ascertain if this investment is suitable for them in light of their financial knowledge and experience, investment goals and financial situation, and/or to obtain specific advice from an industry professional.

The value and income of any of the securities or financial instruments mentioned in this document may fall as well as rise and, as a consequence, investors may receive back less than originally invested. The investment risks described herein are not purported to be exhaustive. Past performance is neither guarantee nor a reliable indicator of future results. Performance data does not include the commissions and fees charged at the time of subscribing for or redeeming shares. Investors investing in investments and/or treasury products denominated in foreign currency should be aware of the risk of exchange rate fluctuations that may cause loss of principal when foreign currency is converted to the investors home currency.

This document is confidential and intended solely for the use of the recipient. It must not be reproduced, distributed or published in whole or in part by any recipient for any purpose without the prior consent of Stouff Capital.

past performance is not a guarantee of future results.