June 3rd, 2019: Oversold short-term, dead-cat bounce coming…

The strong and consensual bullish market sentiment that we saw until the end of April propelled global stocks to one of the best four-month performances seen in many decades. However, in May, we believed a consolidation should occur towards 2721 (the 38.2% Fibonacci retracement from the wave 5 that began in December 2018).

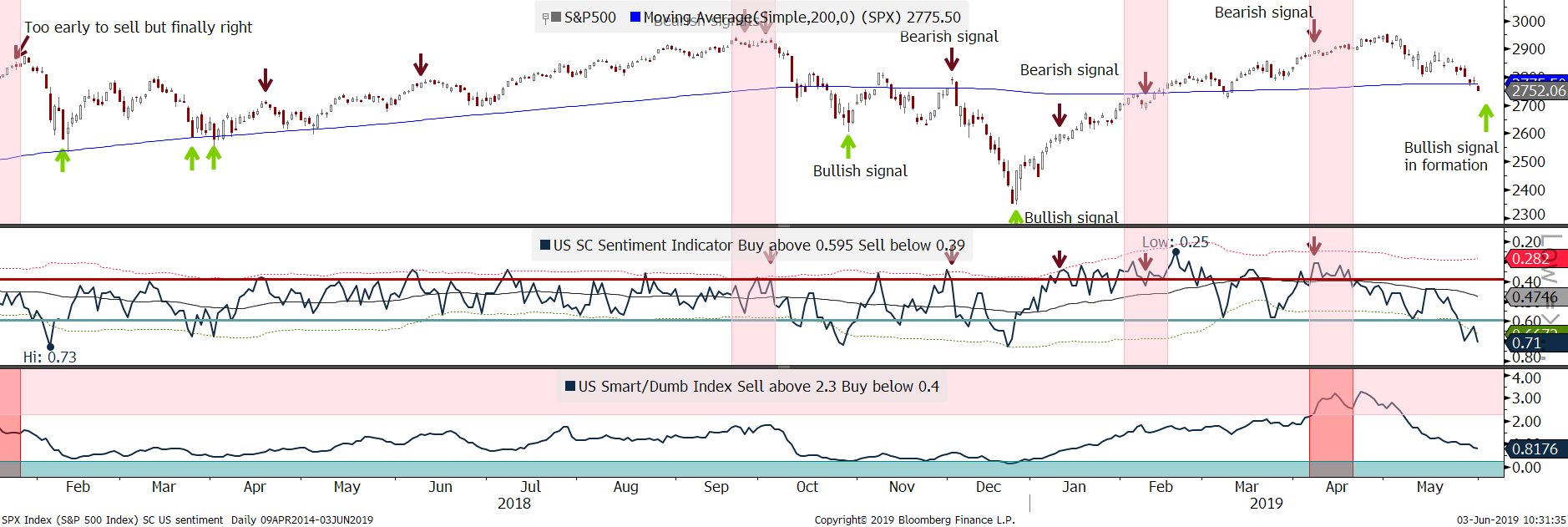

With last week breakdown on global equities, we are now closer to our downside target on the S&P500. An A-B-C corrective wave pattern would predict a rebound from 2721 towards 2864, or even a stronger rebound to a wave V target at 3045. Our US SC sentiment indicator is in a too bearish territory and signals that the S&P500 could rebound at any time (may be today). The May sell-off brought back some fear back to the market, which from a contrarian point of view is a bullish signal for us: figure below shows how US equity sentiment is flashing a clear buying signal on the panel in the middle and is near a medium term buying signal based on the Smart/Dumb indicator.

We observe a recent out-performance of Emerging equities, which we identified a few weeks ago when we partially closed our short on EEM. Also Semiconductors have stopped under-performing the benchmark, while being oversold with bullish diverging RSi. Thus we decide to close our short on the SMH at the open.

Our strategy going into June is to re-adjust our portfolio which worked very well in May. A reversal of the market would hurt most of our current trades. We thus close the Shorts which have been hit the most by the trade wars (EM, US semis, Russel 2000) and prepare a list of trades to benefit from a swift and short rebound from oversold conditions:

1- Long Dax

2- Long Nikkei as Japan is the favoured region from our regional matrix

3- We will also be tactically adding some long trades over the coming days and weeks, such as names which fell too much (i.e. Box, GRUB, AMS)

On the other side, we would UNDERWEIGHT over-owned consensual HEDGE FUND VIP list, like the FAANG and low vol names whose performance versus the benchmark is way too exagerated.

Last but not least, we would buy upside convexity by buying out-of-the-money call options that would be beneficial in the case of dovish monetary policy and appeasement in the Trade war.