May 8th: “they broke the deal” and the rally – don’t buy the dips…

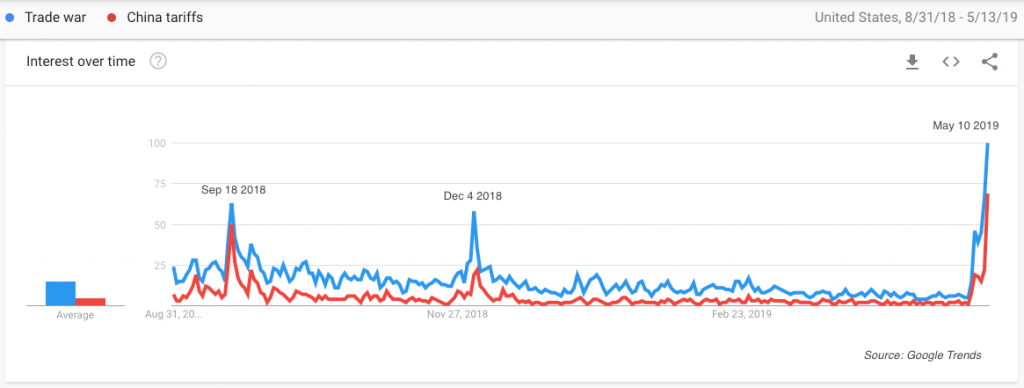

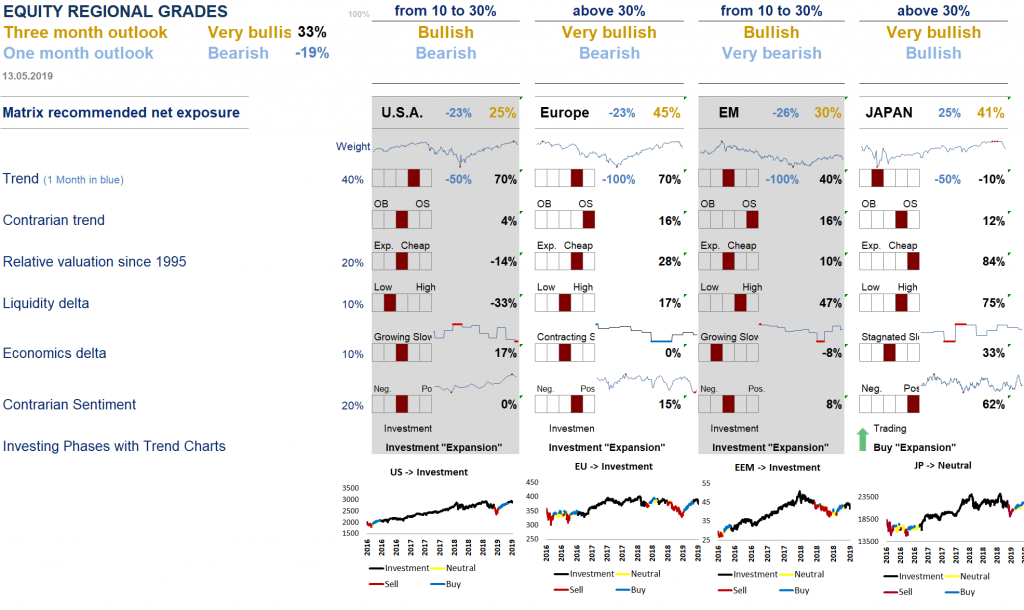

The U.S. raised punitive tariffs to 25%, from 10%, for $200 billion in goods leaving China on Friday and thereafter. President Trump also ordered staff to begin the paperwork to impose levies on the more than $300 billion worth of everything else China sells to the U.S. The curve of VIX futures has moved into the unusual backwardation pattern, which triggers all the more hedges and shorts from Quants than the short exposure in VIX futures from speculators was at one of its highest levels ever. Our SC sentiment indicators had flashed red short term signals at the start of May. Then, our regional matrix is now bearish for the short term on US & European equities and very bearish on EM equities. Indeed, the top-down of our quantamental approach relies on this Equity Regional matrix. This matrix, shown in the below chart, is made up of six indicators that draw data from leading regional indices, indicators and surveys. It informs our net exposure globally and by region, on a medium term and short term outlook. Our short term (one month) outlook has diverged from our 3 month: this is always a complicated risk management decision. In December it was the inverse situation when our one month outlook turned north while our matrix was very bearish on the medium term. What drives the balance in our exposure, when these divergences happen, comes from our contrarian models: they were ultra-bullish in December and we went long, they were ultra-BEARISH two weeks ago and thus we should be short or at least extremely cautious.

Our long term term view is that we changed of regime in January 2018. The QE taught us that low rates are the reason to buy risky assets. And that low rates are there for longer than we imagined. At one point, we must realize that risky assets cannot be propelled higher always as a function reaction to low rates for ever. Risky assets are risky by definition and january 2018 then december 2018 and may 2019 ? ( shorter periods) are tremors of a changing regime, before the final eartkquake. That QE is not reversed would not change really the endgame: as Trump said for his trade deal: they broke it. Risky assets are going to implode. When, in two years ? Or is it already happening?

Yes, from a factor’s point of view: quality has been outperforming in the year to date explosive rise: this is unusual and typical of QE rally. The out-performance of the factor “value”, speeched by most strategists has never worked. This tells us that investors concentrate their holdings in defensive quality names and what we call “the generals”, the mega big stocks.

Consequence: volatility gap. The real risk in this trump tweets is the gap risk that is now haunting us back. We have built our portfolio to be protected and even benefiting from them: indeed as of now, we are up between 50 bps and 1 % while the msci world is down 3 % in 5 days. We believe the environment is shifting again from one where dips should be bought to one where rallies should be sold. Thus the second part of 2019 should be driven by : 1) even if global central banks are accommodative again, risky asset reaction function is broken, 2) earnings and economic growth is set to slow from recent tax-cut fueled highs and trade wars resurgence 3) gap risk and re-surging volatility are limiting risk appetite.