Positionning is giving clues for a coming small correction (small or not).

According to the BofA Fund Managers’ survey, allocation to global equities jumped 10 percentage points month-on-month to a net 31% overweight which is the highest level in a year, while their cash levels — a gauge of risk aversion — are the lowest since March 2013 at 4.2%.

Then, after more than 9 months, the AAII survey of individual investors shows that more than two-thirds of them are finally optimistic. This ends one of the longest streaks in 30 years. Other times that long streaks ended, stocks struggled over the medium-term.

A longer term contrarian data like US CEO turnover in 2019 is at all-time highs. More than 1,400 CEOs left their posts this year through November, that’s up 12% from this point last year. Turnover is even higher than the 1,257 CEOs who exited in 2008 amid the Great Recession. Such tumult at the top is an issue for investors. Early retirement might look all the more appealing if CEOs think the 10-year-old economic surge might be fading: “Things aren’t going to get much better. Time to go.”

The chart below shows our US contrarian sentiment indicators and they are giving clear and extreme short signals.

Outlook

All these very bearish contrarian indicators happen when our technical targets have been reached at least on US equities. The chart below shows that the S&P500 has reached the 3240-3280 wave 3 target, and could correct to the wave 4 target towards 3100 within a few weeks, corresponding possibly to the super Tuesday on March 3rd, 2020.

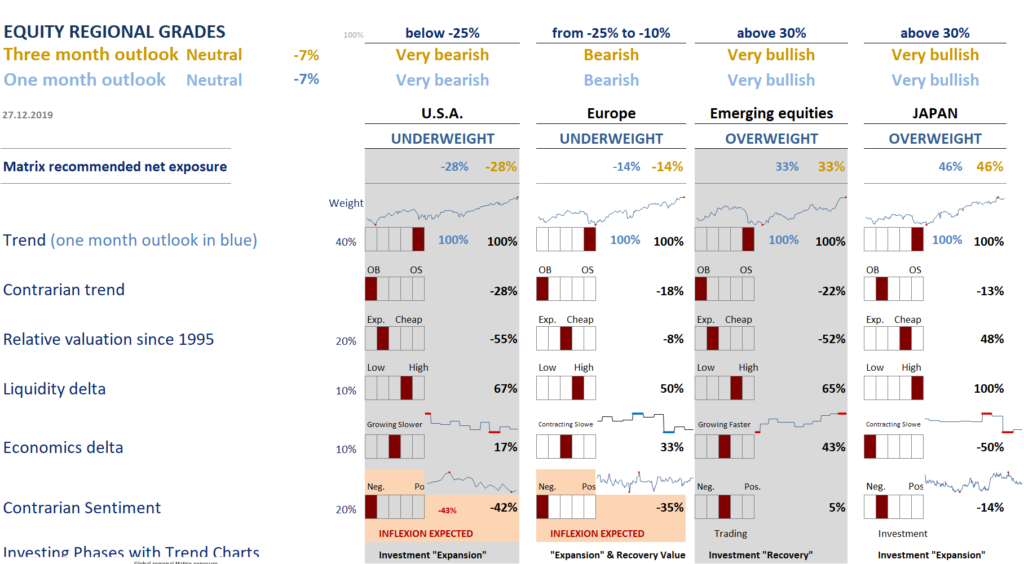

In our July view, we gave a strong probability for the S&P500 to reach the wave 3 target around 3239 (see here) and 3257 in the coming months. We just touched those levels today. And we (our regional matrix and our short term tactical Human view) are now a bit worried, P/E multiple expansion accounted for nearly all of the SPX’s 4Q price return. P/E expansion was driven by declines in Treasury yields (10yr: 2.7% to 1.9%) and credit spreads (1.5% to 1.0%). In fact, there is a major switch in our regional matrix – she has switched from very bullish to bearish/ neutral as our sentiment grades and contrarian trends have triggered an “Inflexion phase”, during which the weight of the Trend grade is replaced by the Contrarian sentiment grade. This “Inflexion” state should statistically stay in order for a few weeks.

We have identified a few headwinds/worries that could emerge in the coming days and serve as catalysts for this correction, such as: (1) While the Fed can continue to grow its balance sheet, we should expect a slowing by late 1Q20. (2) We forecast that better economic data (rebound of PMIs) should support EPS growth but, other factors will likely be neutral-to-negative like credit spreads and volatility. (3) application of Hong Kong SAR human rights bills that prevents the phase 2 US/China trade deal; (4) China slows to 5.5% rather than stabilizes; (5) Democrats nominate a progressive and sweep 2020 elections; (6) US inflation surprises to upside, triggering destabilizing move in US rates and USD; (7) UK fails to agree FTA with EU by end-2020, (8) incapacity of the current US president.